Below are the key highlights from the Bureau of Labor Statistics’s report, The Employment Situation - April 2024.

The employment report has tempered concerns that the US economy is heating up. Fewer hires and shorter workweeks imply a cooling economy, aligning with the desires of policymakers at the Federal Reserve. April’s average weekly compensation fell by less than a dollar due to a 0.1-hour shorter workweek.

Last year and during the first quarter, a resilient labor market saw average monthly payroll increases of over 225,000 workers and wage gains exceeding inflation. Higher incomes fueled increased consumer spending, leading to concerns that the economy was overheated, resulting in added inflationary pressures. Policymakers at the Federal Reserve repeatedly expressed concern that wage growth, particularly in service industries, delayed a return to their target of a 2% inflation rate.

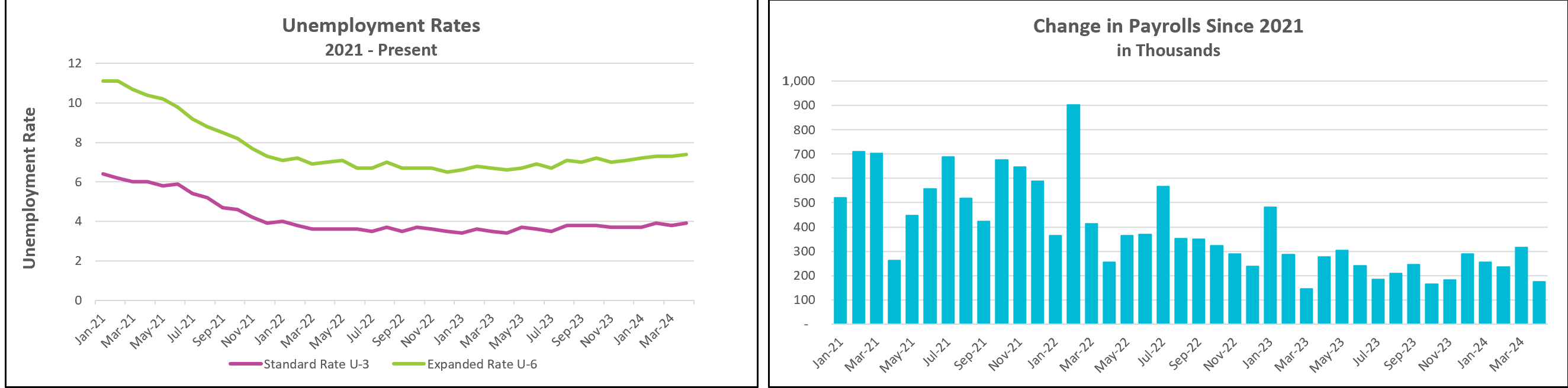

Hirings fell during much of the second half of 2023, but suddenly, the labor market heated up. Stronger-than-expected employment figures in the first quarter contributed to speculation that the Fed would delay reducing its target for the federal funds rate until late this year or even the beginning of next year. However, Friday’s report eased those concerns and increased the likelihood that the Fed would begin cutting rates as early as September.

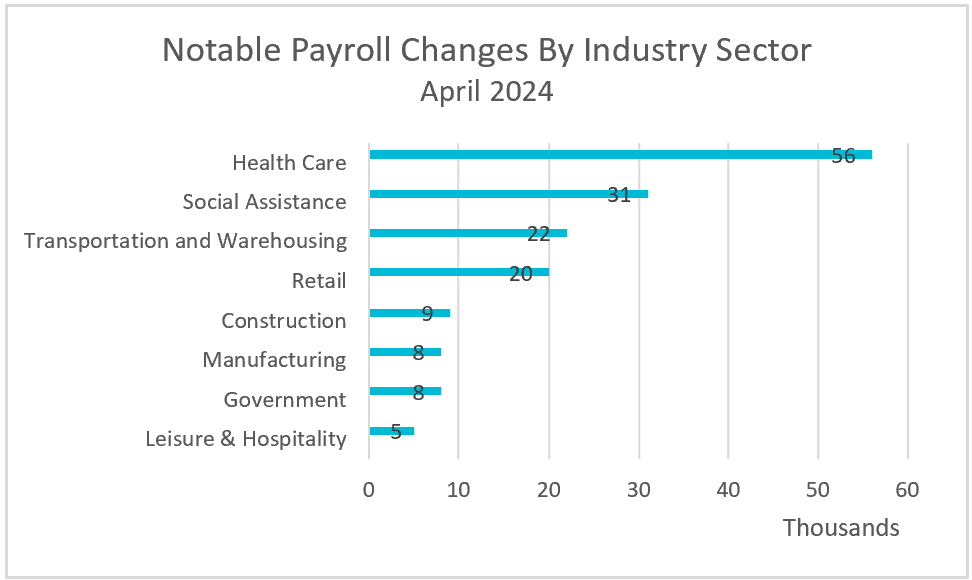

Employment growth during April was broad-based, with very few industries experiencing a payroll drop. However, retail, social assistance, and trucking and warehousing are among the few categories where April’s payroll growth exceeded March’s.

The fall in temporary workers for the third consecutive month is also a sign that the labor market is softening. Economists use the employment of temporary workers as a leading indicator, as they are frequently the first hired and the first let go.

U6, a broader measure of unemployment, increased to 7.4%, the highest it has been since November 2021. U6 includes people whose employment status has been harmed by the state of the economy, either by being unemployed, discouraged, or forced to work part-time.

While this report showed a softening of the labor market, it did not indicate that the economy was unhealthy. Payroll gains before the pandemic averaged 178,000. Instead, it provides evidence that the Fed’s strategy of slowing economic growth to cool inflation is working.

Policymakers will closely monitor the Labor Department’s release of the Consumer Price Index for April on May 15th. While it may not be the Fed’s preferred measure, it will provide valuable insights into inflation trends for April. Shortly after its release, a comprehensive summary and analysis will be accessible at HigherRockEducation.org.