Employers scaled back hiring to the lowest level since December as the disparity between job openings and the available workforce has diminished. Nevertheless, the labor market maintains its robustness as wages continue growing more than inflation. After pausing the rate hikes to assess the impact of raising the target rate from zero to five over the previous 10 meetings, the latest Employment Summary supports those policymakers who advocate for resuming the gradual increment of their benchmark rate to moderate economic growth and reduce inflation.

The highlights from the Bureau of Labor Statistic’s report, The Employment Situation – June 2023, are listed below.

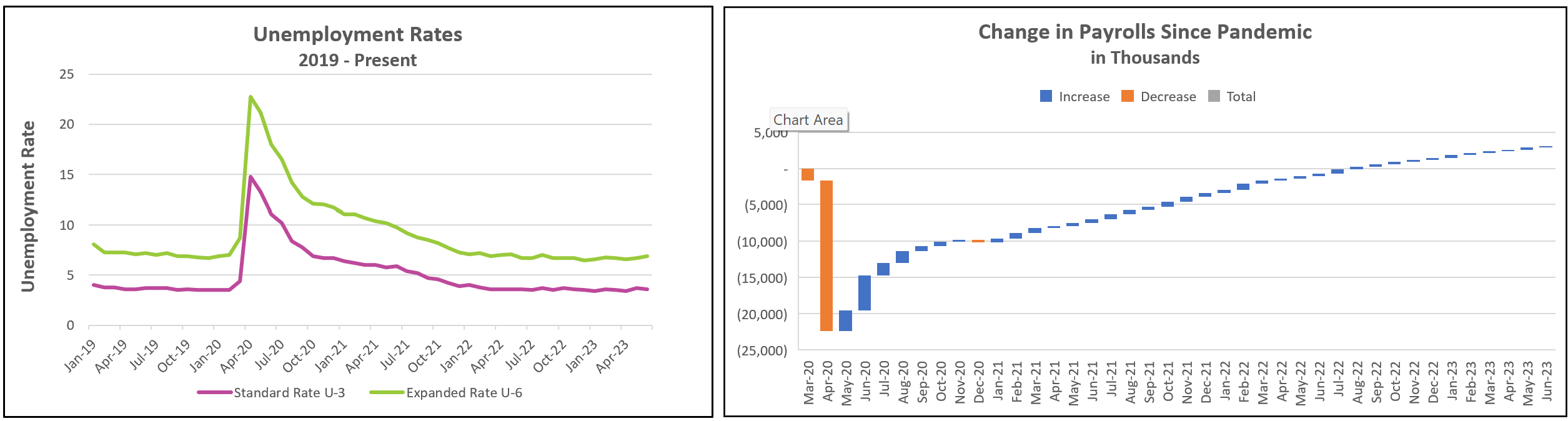

The job market continues to exhibit strength and resilience. Notably, the unemployment rate has declined, reflecting a decrease in the number of individuals actively seeking employment and unable to secure jobs. Payrolls have expanded for 30 consecutive months. The average workweek witnessed a slight increase, suggesting a growing demand for labor to meet business requirements. June saw an increased engagement and participation in the labor market among individuals in the primary working age group.

The demand for workers continues to exceed the supply of willing workers. During the early stages of the pandemic, businesses were compelled to reduce their labor force in response to the unprecedented challenges posed by the crisis. As a result, many individuals exited the labor market and have yet to return, creating a persistent workforce gap. Industries such as leisure and hospitality, healthcare, and government are still grappling with the lingering effects of the pandemic-induced losses.

Employment in leisure and hospitality, which encompasses hotels, restaurants, and entertainment venues, is 362,000 less than in February 2020, just before the pandemic. Government employment is also continuing to recover, employing 161,000 fewer people than before the pandemic.

Demand continues to escalate in the healthcare sector as the aging population has strained healthcare services, leading to an amplified need for healthcare professionals across various specialties.

Furthermore, the housing shortage and the pressing need to expand the nation’s infrastructure have fueled a heightened demand for construction workers. The growing population and the need for improved housing options have underscored the urgent need for skilled labor in the construction industry. Simultaneously, the government’s initiatives to bolster and modernize infrastructure, such as transportation networks, bridges, and public facilities, have further contributed to the demand for construction workers.

However, recent indicators suggest that the rate increases implemented by the Federal Reserve have slowed the economy’s growth. One notable effect has been a deceleration in the pace of hiring. Although the unemployment rate has declined, a broader measure of unemployment known as U-6, which includes individuals working part-time who would prefer full-time employment, has risen for the fourth consecutive month, reaching its highest level since August 2020. The gap between available workers and job openings has decreased from over two openings per willing worker early in 2023 to 1.6 in June, suggesting a potential cooling of the labor market. Businesses have been increasing wages to attract and retain workers. In June, wage growth exceeded inflation, offering some respite from rising prices.

The increase in the U-6 measure of unemployment signifies a growing number of individuals who cannot secure full-time employment or are working fewer hours than they desire. This trend may indicate that businesses are implementing cutbacks and reducing their workforce or shifting towards part-time employment arrangements.

The growth in the number of part-time workers further supports the notion that businesses are scaling back their operations. By relying more heavily on part-time employees, companies adjust to a more cautious economic outlook and mitigate potential risks associated with higher labor costs.

So, what will policymakers at the Federal Reserve do when they meet on July 25 – 26? Most analysts expect them to raise their benchmark rate by 0.25%. The recent steady increase in wages remains a significant concern because wage trends can perpetuate inflationary pressures within the economy. When businesses increase wages, it is often accompanied by a corresponding price increase to offset the additional labor costs. This relationship between wages and prices is known as the wage-price spiral.

When businesses raise wages, employees have more disposable income, empowering them to cope with the higher prices set by those same businesses. This increased income enables families to absorb the impact of rising costs. As a result, the cycle continues, with companies adjusting prices in response to higher wages, and consumers relying on their increased income to meet those elevated prices.

For policymakers at the Federal Reserve, this wage-price spiral presents a delicate balancing act. On the one hand, wage increases can stimulate consumer spending and contribute to economic growth. On the other hand, if wages rise too quickly and outpace productivity growth, it can fuel inflationary pressures, eroding the purchasing power of individuals and undermining the stability of the economy.

The employment report suggests that a robust labor market will maintain inflationary pressures. We will learn more on July 12th, when the Bureau of Labor Statistics releases Consumer Price Index – June 2023. Check back to HigherRockEducation.org shortly after its release for our summary and analysis.