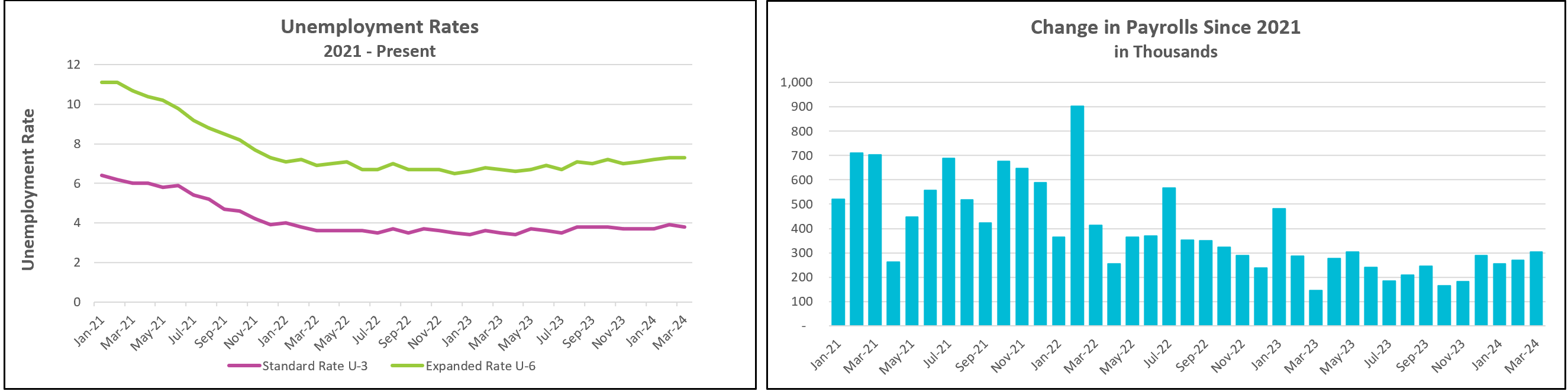

Employers ramped up hiring at an unexpectedly brisk pace in March, contributing to a drop in the unemployment rate. However, the influx of new workers tempered the growth in wages.

The highlights from the Bureau of Labor Statistics’s report, The Employment Situation – March 2024, are listed below.

The unemployment rate declined despite a rise in the labor force, indicating that the majority of individuals entering the workforce have secured employment. Economists had concerns that a growing economy and labor scarcity would fuel inflationary pressures as employers competed for workers. However, these concerns seem to have been unfounded throughout last year and the early months of 2024. Enhancements in productivity have dampened the demand for workers. The supply of workers has expanded by 469,000 individuals due to people returning to work and a surge in immigration. In March, the labor participation rate climbed by 0.2% to 62.7% of the population. These factors combined have alleviated the labor shortage that was prevalent in the aftermath of the pandemic.

Employment growth was broad-based, with a particularly strong presence in service-related industries. Hires in healthcare, government, and leisure and hospitality accounted for nearly half of the payroll increases in March. Notably, the leisure and hospitality sector finally regained its pre-pandemic level after adding 49,000 workers.

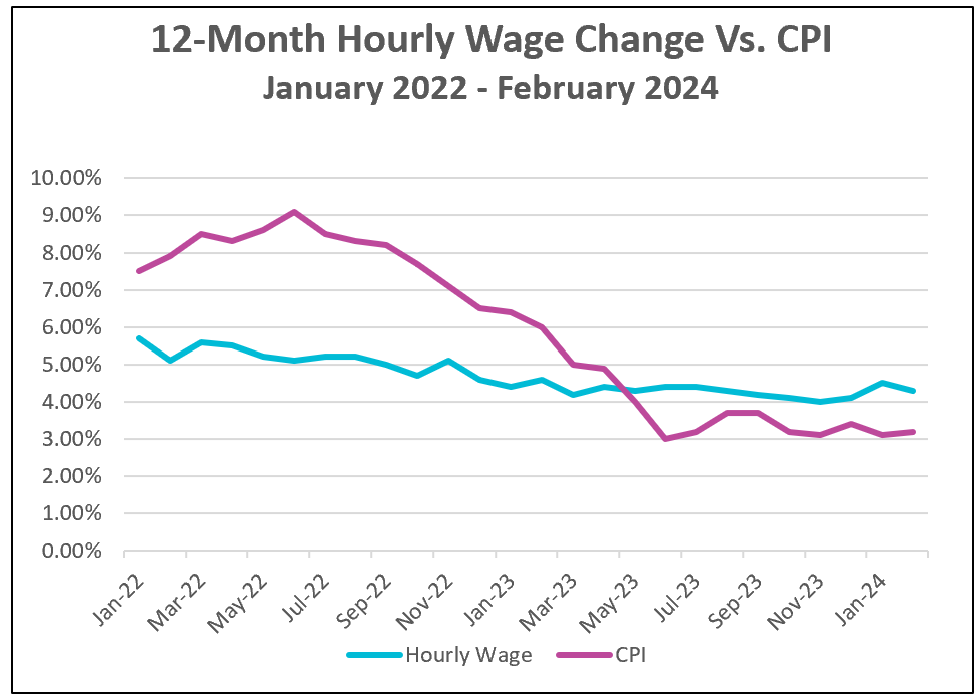

While average hourly earnings slightly increased in March, but they declined when measured over the previous 12 months. Despite this, they have generally outpaced inflation since May 2023, providing households with increased purchasing power. However, higher real wages also complicate the Federal Reserve’s task of managing inflation. Elevated real incomes stimulate consumer spending, often prompting businesses to raise prices. Analysts are revising their projections for when Federal Reserve policymakers might initiate interest rate cuts. Current data offer little persuasion to policymakers that the economy is on the brink of recession, likely postponing any rate adjustments.

Policymakers will closely monitor the Labor Department’s release of the Consumer Price Index for March on April 10th. While it may not be the preferred measure, it provides valuable insights into inflation trends for March. After its release, a comprehensive summary and analysis will be accessible at HigherRockEducation.org.