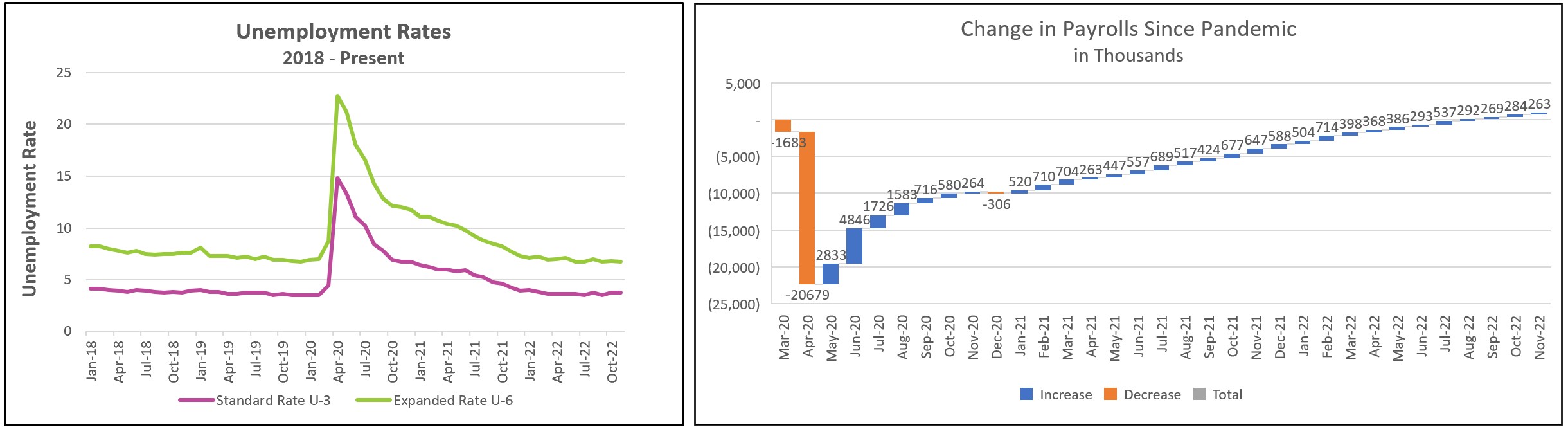

The labor market remains tight, adding pressure to wages and inflation. Payrolls continue to grow, and there are more job openings than people willing to fill them. The unemployment rate remained near its forty-year low. Income gains have helped fuel robust consumer spending. While the strong labor report is good for workers, it increases the central bank’s challenge to tame inflation.

The highlights from The Employment Situation - November 2022 are listed below.

Higher interest rates and slowing global economies have not sufficiently cooled the labor market to persuade policymakers at the Federal Reserve to discontinue their aggressive monetary policy. Employers added 263,000 workers to their payrolls in October, significantly more than in 2019 (before the pandemic), when monthly average payroll increases equaled 169,000 workers.

Two-thirds of the payroll increase occurred in leisure and hospitality (88,000), health care (45,000), and government (42,000). These groups were among those hit the hardest by the pandemic. Employment in leisure and hospitality and government remain below prepandemic levels.

People are leaving the labor force – when workers are needed. There were 1.7 job openings for every person who was unemployed in November. The civilian labor force has decreased for two consecutive months, dropping the labor participation rate to 62.1% and exacerbating the labor shortage. Approximately 3.4 million people would be added to the workforce if the participation rate equaled 63.4%, the rate in February 2020. Much of the gap is because older workers retired rather than returning to work as the pandemic waned.

Employers continue to bid up wages to attract and retain workers. Hourly wages rose 0.6% in November, the largest gain since January. However, wage gains will likely remain less than the inflation rate measured by the consumer price index when the BLS releases the CPI in two weeks. (It is interesting to note that the monthly increase in the October PCE price index (0.3%) was less than the monthly gain in personal income (0.7%). The PCE price index is usually lower than the CPI.)

Chairman Powell wants the labor market to soften. He recognized the labor shortage in a speech last week when he presented the central bank’s strategy in his speech on November 30th. (Federal Reserve) Powell explained how significant containing labor costs are to reducing the inflation rate. Service industries comprise over 70% of the US economy. Wages in service industries increased 5.3% from a year ago – more than the overall average. Wages are usually the largest expense for companies in service industries. Many of these companies have the greatest shortage of workers, so logically, workers in the service industries have benefited from some of the largest percentage wage increases. The higher labor costs have pushed up prices because employers have increased their prices to maintain their profit margins. Policymakers will continue to monitor the current balance between the supply and demand for workers because an imbalance could suggest that inflation will persist.

Policymakers at the Federal Reserve have increased their benchmark rate six times since the beginning of the year. Their objective is to reduce the economy’s aggregate demand. Doing so would reduce the economy’s labor demand and relieve some pressure on companies to increase wages. Chairman Jerome Powell has been clear that the Fed will continue to raise interest rates until the labor shortage is reduced. He recognizes the hardship higher rates bring – but inflation causes more pain in the long run.

Interest-rate-sensitive industries such as real estate have already felt the impact of higher rates. The National Association of Realtors reported that existing home sales plummeted 5.9% and “More potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher, with the impact greater in expensive areas of the country and in markets that witnessed significant home price gains in recent years.” Approximately 10% of jobs are tied directly or indirectly to real estate. Some jobs include builders, trade contractors, real estate brokers, appraisers, inspectors, insurance companies, mortgage companies and lenders, title companies, and furniture manufacturers and sellers. So, if the housing market contracts, it will reduce the demand for labor in each of these professions and slow economic growth.

Real estate is one of many industries with slowdowns. Several tech companies, including Twitter, Meta, Amazon, and Microsoft, have announced large layoffs. Transportation, warehousing, and retail companies cut payrolls in November, reflecting the trend in spending away from goods to services. The growth in e-commerce also impacted retail jobs. Walmart announced it was hiring fewer than in past years this Holiday season.

The manufacturing sector benefited from payroll gains but also showed signs of a softening market. The average workweek fell for the first time since June. The purchasing managers’ index fell below 50 for the first time since June 2020. The index measures trends in the manufacturing sector by surveying supply chain managers in 19 industries. A reading below 50 implies that most managers anticipate a contraction of the manufacturing sector.

This report summarizes a robust labor market with continued job growth and rising wages. Low unemployment and healthy wage gains have prevented the economy from entering a recession – but they have also contributed to inflation. Current statistics do little to dissuade policymakers at the Federal Reserve from changing its monetary policy (although the FOMC may reduce its rate increase). However, members of the FOMC will be very interested in the Bureau of Labor Statistics’ monthly publication, Consumer Price Index – November 2022, which will be released on December 13th, the day before the FOMC meets. Check back to HigherRockEducation.org shortly after its release on December 13th for our summary and analysis.