Below are the highlights from the Bureau of Economic Analysis’s Personal Income and Outlays report for December 2024:

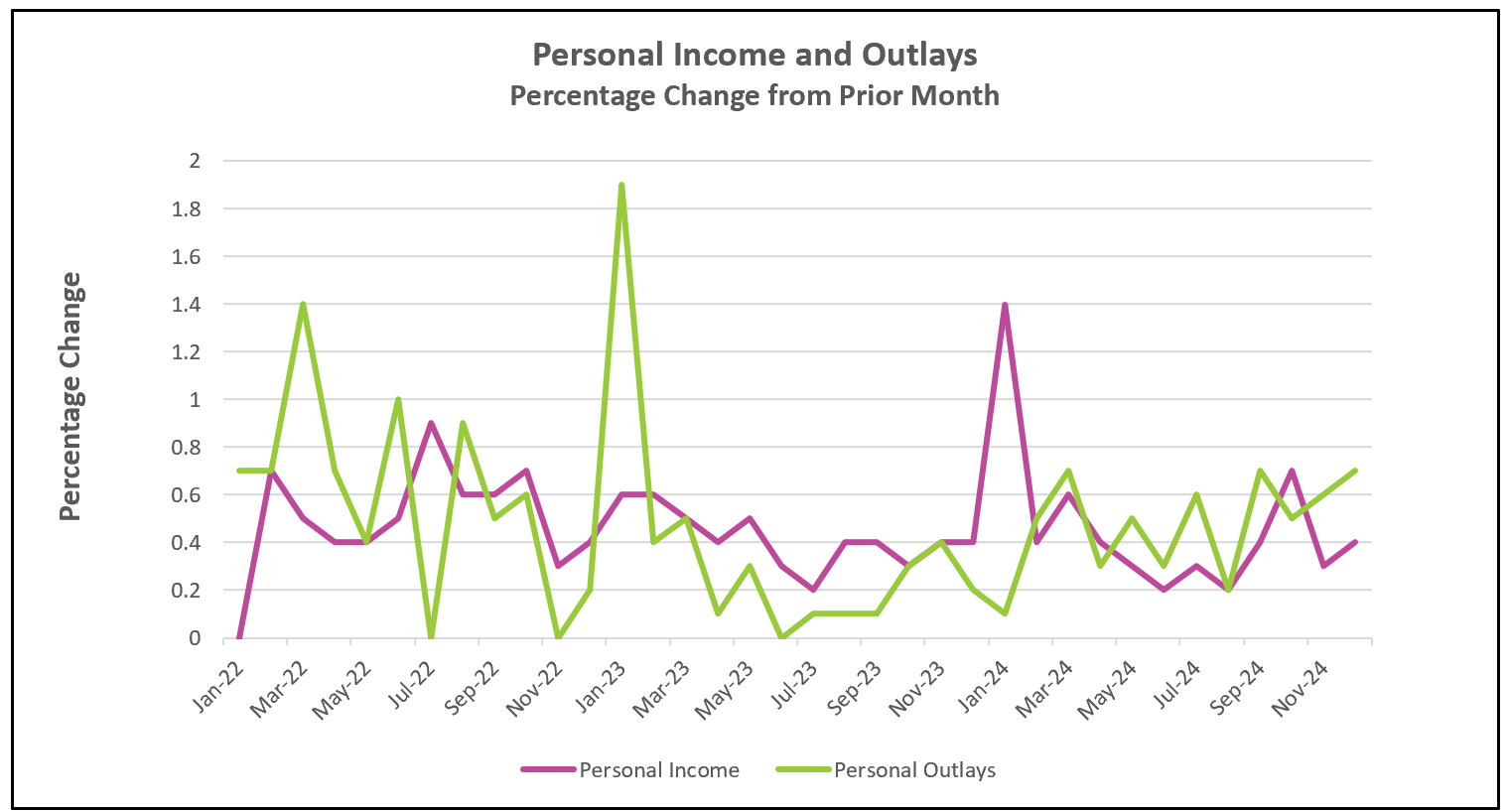

Earlier this week, Federal Reserve policymakers met and chose to maintain its benchmark rate after cutting it in its last three meetings. Federal Reserve Chairman Jerome Powell cited a healthy economy as the reason for holding rates steady. (Fed’s Press Release) This report supports Chairman Powell’s claim. Consumer spending has risen for 18 consecutive months, continuing to be the primary driver of economic growth. Higher incomes have sustained higher consumer spending, while disposable income has exceeded or equaled inflation every month since May 2022.

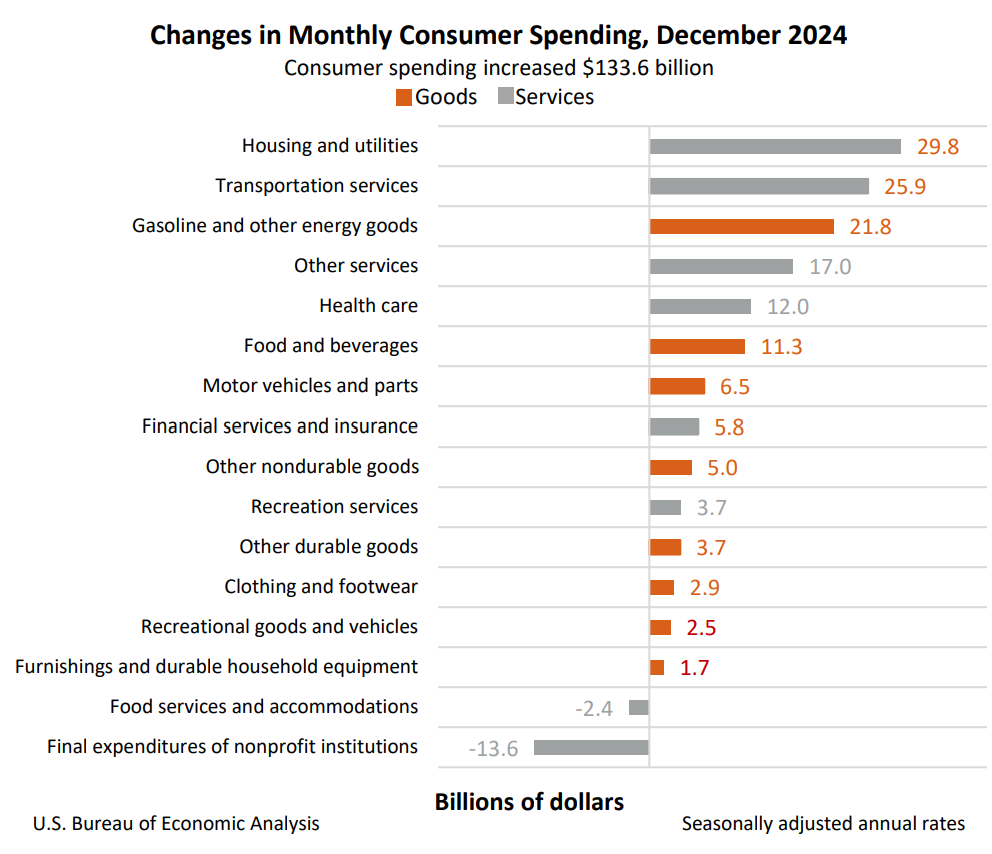

The largest spending increase was for goods. Gasoline prices rose 4.4% in December, while motor vehicle sales rose in advance of possible tariffs. Service sales also rose, led by housing and utilities.

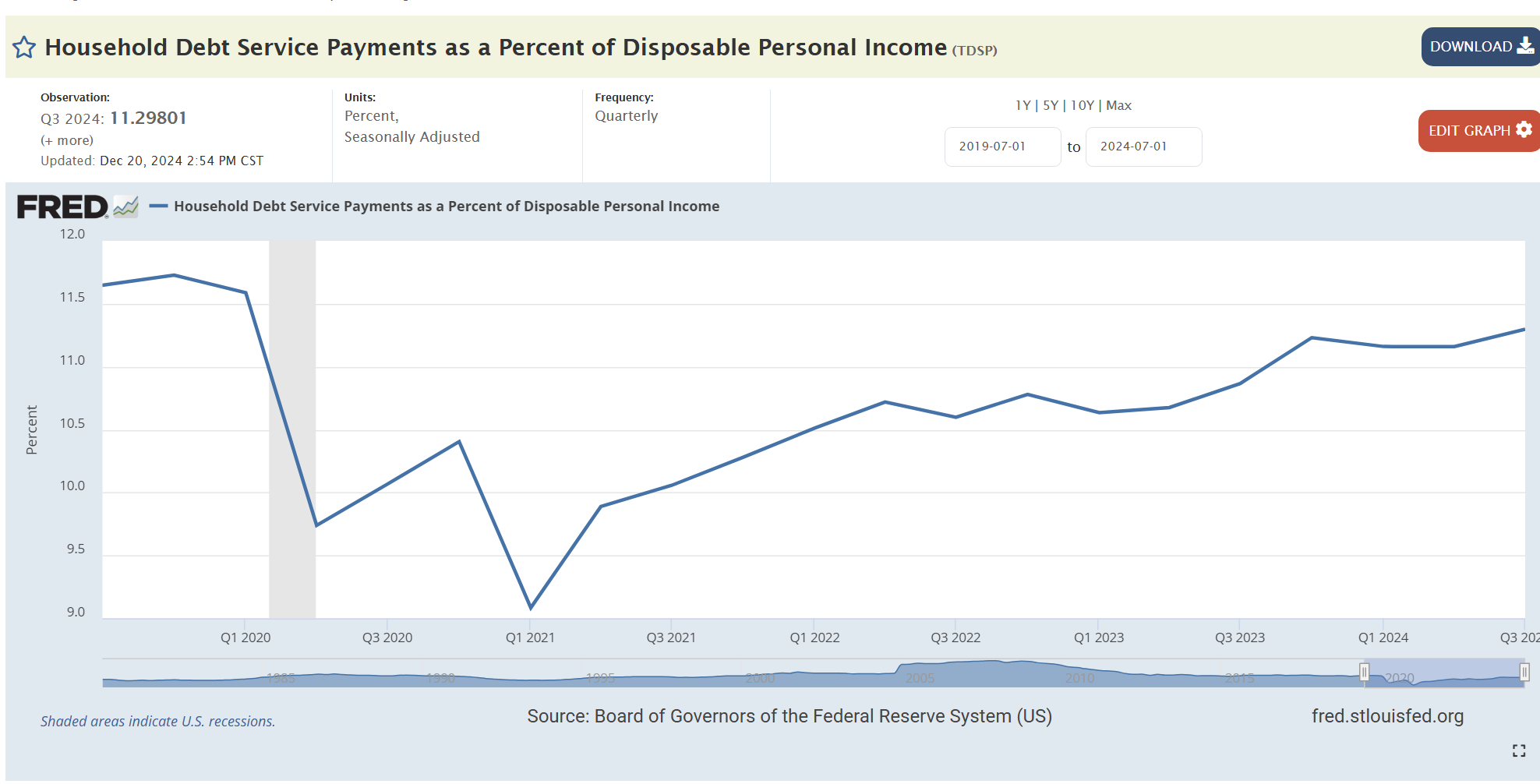

However, there are signs that the economy may be nearing its peak. While income has grown, it has barely kept pace with inflation since June, likely prompting consumers to draw from their savings. The savings rate has declined over the past two years, while borrowing has increased, accompanied by a rise in delinquencies.

However, there are signs that the economy may be nearing its peak. While income has grown, it has barely kept pace with inflation since June, likely prompting consumers to draw from their savings. The savings rate has declined over the past two years, while borrowing has increased, accompanied by a rise in delinquencies.

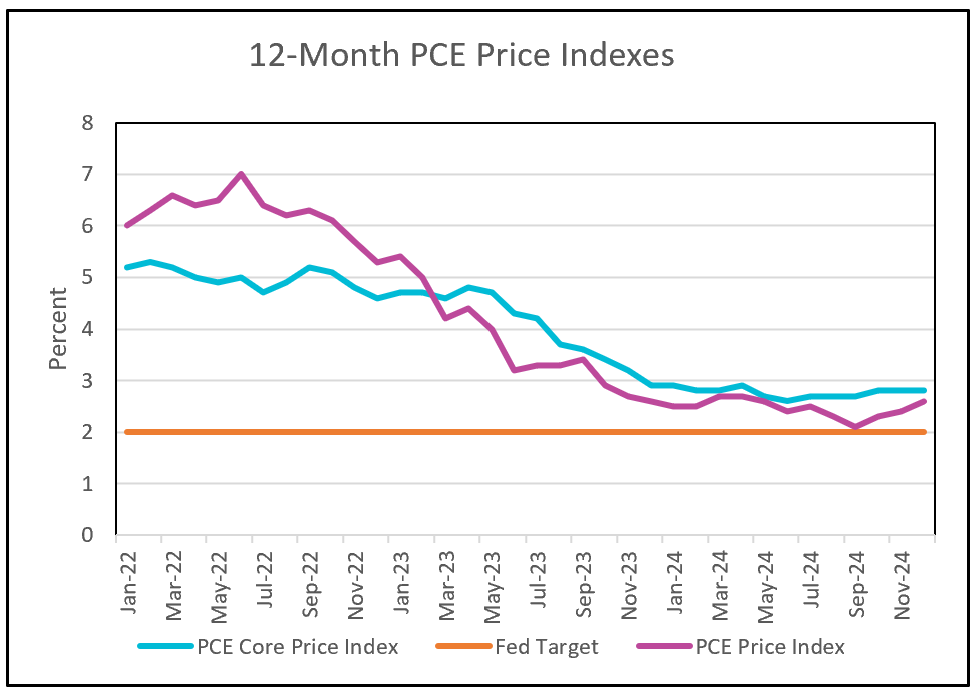

A recent uptick in inflation also discouraged the Fed from cutting rates. The all-inclusive price index rose for the third consecutive month, while the core PCE price index held steady at 2.8% over the past three months, edging up from its 2.6% low in June. Economists prefer the core index as it excludes volatile food and energy prices, offering a clearer view of underlying inflation trends. For example, the graph below shows that the core index was lower than the all-inclusive index in 2022 when gasoline prices surged but rose above it in 2023 as gasoline prices fell sharply. Recently, with gasoline prices climbing again, the gap between the two indexes has narrowed.

Finally, the Federal Reserve is proceeding cautiously in response to President Trump’s proposed tariff increases on imports from Canada, Mexico, and China, citing concerns over potential economic repercussions. The impending implementation of a 25% tariff on Canadian and Mexican imports and a 10% tariff on Chinese goods, set for February 1, 2025, has already fueled uncertainty in financial markets. Economists warn that these tariffs could drive inflation higher by increasing import costs, ultimately raising prices for American consumers. This inflation risk complicates the Fed’s monetary policy decisions as it seeks to balance economic growth with price stability. The Fed will closely monitor the impact of tariffs. Stay tuned for Higher Rock’s 2025 predictions, set to be published on Monday.