The Silicon Valley Bank collapse has put policymakers at the Federal Reserve in a precarious position to decide whether to aggressively increase their benchmark rates after two reports that show only a slight moderation of inflation or to reduce their benchmark rate.

The highlights and analysis of the Bureau of Labor Statistics press release, Consumer Price Index – February 2023, are summarized below.

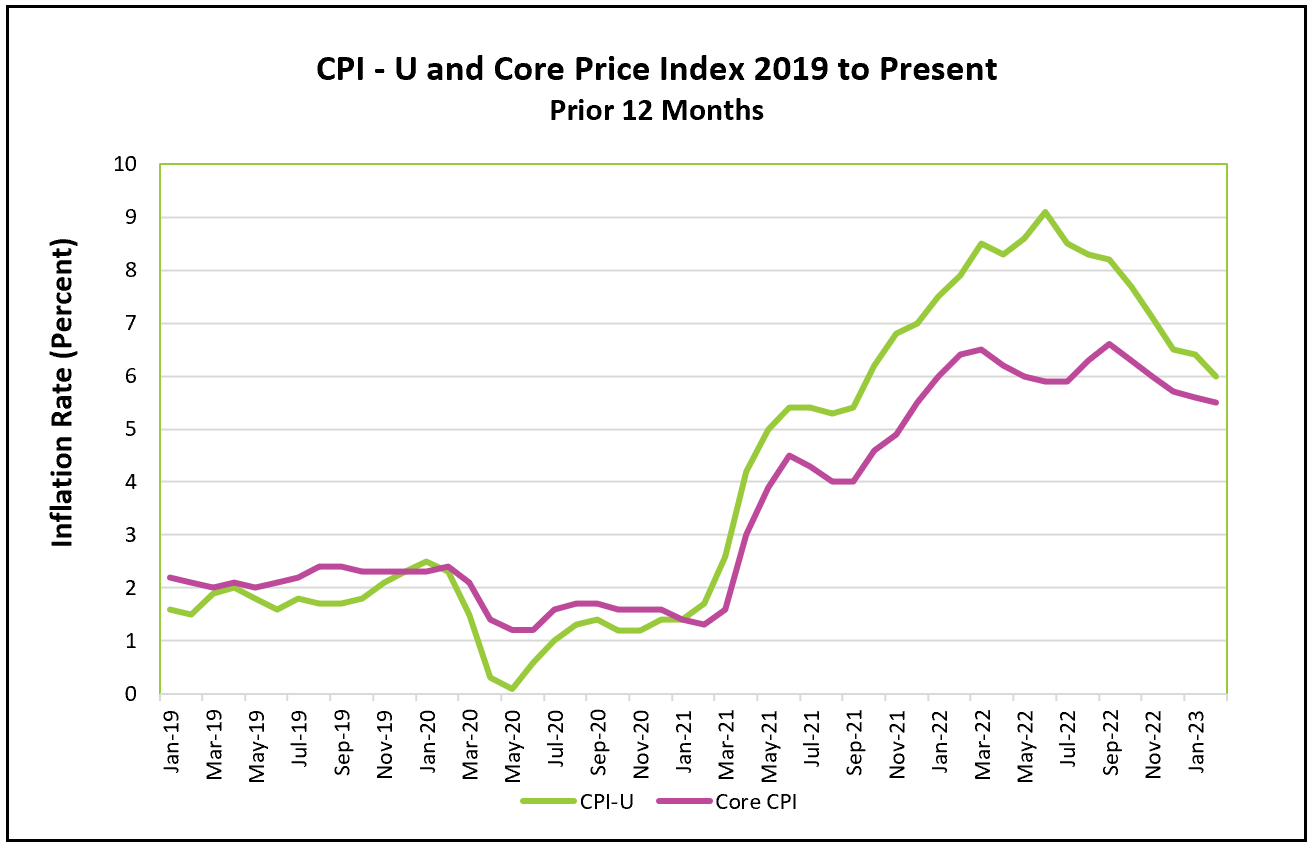

Last Friday, the Bureau of Labor Statistics (BLS) reported that the labor market was too healthy, showing little evidence of slowing to reduce inflationary pressures. Payrolls increased by 311,000. Job openings continue to outpace people willing to work. The growth in wages slowed slightly. Tuesday’s inflation report was more discouraging. It is true that inflation, when measured over the prior 12 months, decelerated in February, resuming a trend that began at the end of 2022. Homeowners paid less to heat their homes, with natural gas dropping 8.0% and fuel oil falling 1.7%. However, the shelter index rose 0.8% and contributed 70% to the monthly all-inclusive price index increase. Also discouraging was an uptick in the monthly core index, which rose to 0.5% in February. Economists prefer the core index when evaluating trends because it excludes volatile food and energy prices

Real wages, or wages after adjusting for inflation, fell 0.2% in February. Over the past 12 months, they are down 1.4%, meaning wage earners must spend a more significant portion of their paycheck to purchase the same goods and services.

Then the bombshell dropped. Silicon Valley Bank (SVB) had a bank run and had to be rescued by the Federal government on March 10th. It was the second-largest bank failure in US history. Signature Bank (SBNY) soon followed. Higher interest rates contributed to both failures.

![]()

Image from iStock

Silicon Valley Bank primarily served startups and venture capital firms. It did business with them before the bigger banks would. Their clients were flush with cash, so SVB’s deposits rose from approximately $50 billion to $200 billion between 2019 and 2022. Meanwhile, lending activity slowed. Management’s challenge was finding a place to invest its deposits. It chose government securities. As interest rates increased, the value of government securities fell significantly. That would not have mattered if SVB held the securities until maturity. But a surge in bank withdrawals forced their sale when the recession and turmoil in the tech industry precipitated cutbacks in venture capital funding. Startup companies withdrew their deposits to fund operations, and outflows began exceeding inflows early in 2023, forcing SVB management to sell some of their bond portfolio at a significant loss. Word got out, and the bank run was on. The run was more severe because over 80% of SVB’s deposits were large and uninsurable. There was little incentive for companies to leave their deposits in Silicon Valley Bank when FDIC did not insure them.

Experts are concerned the bank runs may spill over to other banks. President Joe Biden and government officials quickly assured the public that the banking system is safe. It is. But that doesn’t mean other banks are not susceptible to runs. Banks heavily invested in long-term debt securities are vulnerable because those securities have likely depreciated. They would be in trouble if withdrawals exceeded deposits by a significant amount. If this is a concern, a bank’s management may make fewer loans to increase its reserves. If so, it would unintentionally slow the economy – as would an increase in rates.

Policymakers at the Fed are meeting on March 22 and 23 to adjust their monetary policy. They will not waiver in their resolve to slow the economy as inflation remains well above their 2% target. However, they will also be monitoring the banking system closely. They will likely increase their benchmark rate by 0.25% if there are no more bank runs, but they will leave rates unchanged or even lower them if a more severe banking crisis develops.

On March 31st, the Bureau of Economic Analysis will release Personal Income and Outlays – February 2023. Policymakers will pay particular attention to consumer spending, hoping gains will continue to moderate. They will also take note of the PCE price index, the price index favored by the Federal Reserve. January’s indexes, like the CPI, reversed their trend and rose after falling for several months. Check back with HigherRockEducation.org shortly after its release for our summary and analysis.