State of the Economy - July 2020

It was not a surprise when the Commerce Department reported that the U.S. economy contracted 9.5% in the second quarter. Containment measures and approximately $3 trillion in aide prevented a steeper recession, but more is needed – just when most of the programs put in place have expired. Federal Reserve Chairman Jerome Powell stated at a recent news conference, “it looks like the data are pointing to a slowing in the pace of the recovery”. A recent spike in coronavirus cases has discouraged consumers while delaying the opening of many businesses. Fewer workers were rehired in July than in June. What should be done? Several actions including President Donald Trump’s recent executive orders are discussed in the Summary and Analysis section at the end of this post.

To understand where the economy is and where it is headed, July’s economic numbers need to be reviewed.

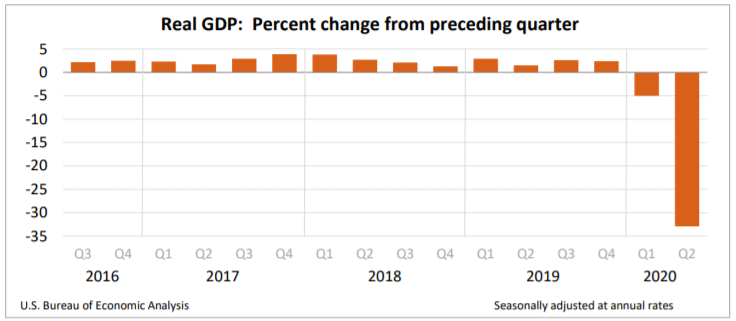

Real Gross Domestic Product (RGDP)

The second quarter of 2020 began with states taking drastic containment measures to slow the spread of COVID-19, including closing many businesses and encouraging people to remain at home. The quarter ended with policy makers debating how to restart the economy while limiting COVID’s harm. Meanwhile, COVID-19 cases and deaths attributed to the virus grew. Many people became more apprehensive about their health, their jobs, and the future. Only an increase in federal government spending and a smaller reduction in net exports contributed to a higher real gross domestic product (RGDP). All other components were weaker than the prior quarter: including personal consumption expenditures (PCE), and business investment. The economy shrunk $1.8 trillion. Personal income rose, but largely because of transfer payments made by the federal government. PCE, which comprises approximately 66% of the economy, fell sharply. Readers can access the report at the Gross Domestic Product, Second Quarter 2020, Advance Estimate.

- RGDP fell 9.5% in the second quarter, which equates to a 32.9% annual rate. This follows a 5% contraction in the first quarter.

- Consumer spending fell an unprecedented 34.6% in the second quarter. Most of the harm was in the service industries, which saw a 43.5% decline. (Both rates are expressed as annual rates.)

- Gross private domestic investment decreased 49%.

- Federal government expenditures increased at an annual rate of 17.4% in the second quarter.

- The PCE price index, the inflation measure most closely monitored by the Federal Open Market Committee, fell 1.9% in the second quarter following a 1.3% increase in the first quarter.

- The core PCE price index, which excludes food and energy prices, fell 1.1% after increasing 1.6% last quarter.

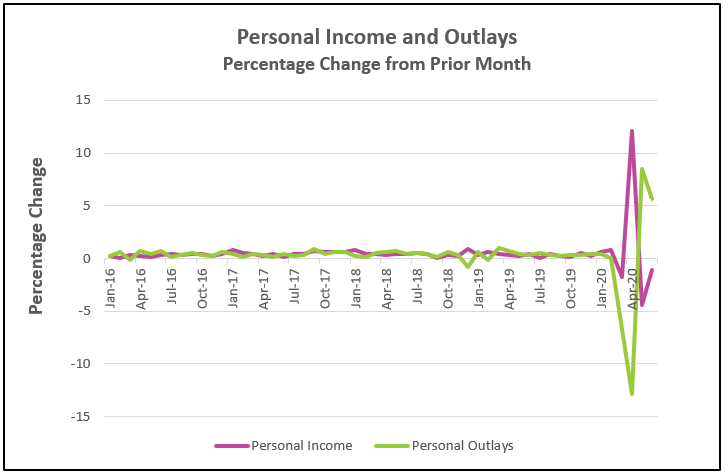

Personal Income and Outlays

Consumer spending increased in June because businesses continued to re-open and consumers ventured into the marketplace more frequently and many households spent the stimulus payments they received from the federal government. Personal income fell for the second straight month in June because the reduction in government transfer payments ($484 billion) was greater than the increase in compensation to employees ($245 billion) and proprietors’ income ($80 billion). Consumer spending remains approximately $1 trillion below pre-pandemic levels. Prices as measured by the PCE price index increased but remain below the Federal Reserve’s 2.0% target. Read the full report by following the link Personal Income and Outlays, June 2020. The highlights are listed below.

- Personal income decreased 1.1% in June following a 4.4% decrease in May (revised from 4.2%).

- Personal consumption expenditures continue to increase as the economy reopens, gaining 5.6% in June, which follows a 8.5% increase in May (revised from 8.2%).

- The PCE price index increased 0.8% over the prior 12 months, while the core price index rose 0.9%.

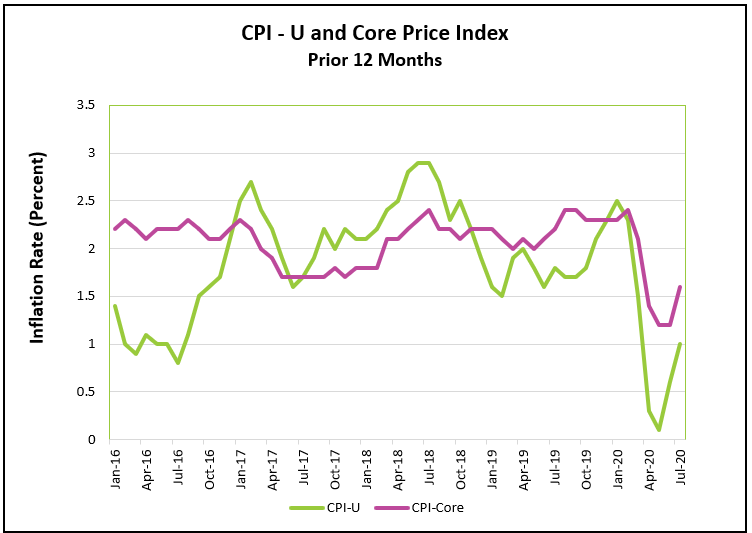

Consumer Price Index (CPI)

Increases in the demand for goods and services that had been reduced by the containment measures propelled prices higher. The core index increased more than any month since January 1991. Economists prefer the core price index because it is more representative of price trends since it excludes volatile food and energy prices. The largest increases in the core index were apparel (1.1%), used cars (2.3%), vehicle insurance (9.3%) and airfare (5.4%). Read the full report by visiting Consumer Price Index – July 2020. Here are the highlights of the report.

- The consumer price index for all urban consumers, CPI – U, increased 0.6% in July matching the 0.6% jump in June. The price level has increased 1.0% over the prior 12 months.

- The core price index also increased 0.6% in July. Over the prior 12 months core prices have increased 1.6%.

- Gasoline prices increased 5.6% in July and accounted for approximately 25% of the monthly rise in the CPI-U. However, gasoline prices remain 20% lower than 12 months ago.

- In July, food prices fell 0.4%, helped by a 1.1% decrease in food at home prices because the demand for food purchased at grocery stores was diminished by more people purchasing meals from restaurants.

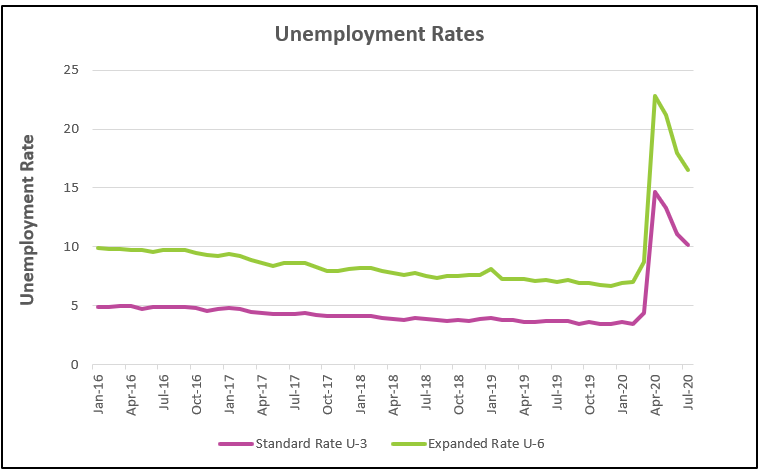

Employment

The unemployment rate has fallen for three consecutive months as communities continue to reopen following the imposition of containment measures in March to combat COVID-19. But people returned to work at a slower pace in July than in June. Employers appear reluctant to hire when COVID continues to spread and states and cities reconsider reopening. The stubbornly high number of permanent job losses is indicative of businesses shutting down as the likelihood of a quick recovery seems less certain. The highlights from The Employment Situation – July 2020 are listed below.

- The unemployment rate fell to 10.2% in July. The jobless rate has continued to fall since it peaked at 14.7% in April – but remains much higher than in February when it reached a historic low of 3.5%.

- 16.3 million people remain unemployed.

- 1.8 million people were added to payrolls in July - 3 million people fewer than in June.

- 7.5 million jobs of the 22 million lost since the pandemic have now returned.

- The number of people who permanently lost their job remains historically high at 2.9 million people.

- U-6, the broader measure of unemployment, equaled 16.5%, down from its peak of 22.8% in April. The U-6 rate includes part-time workers who would prefer to work full-time and discouraged people who would like a job but gave up looking.

Summary and Analysis

The immediate future is dimmer than several months ago when economists and policy makers predicted a severe recession would be followed by a speedy recovery. Containment measures were expected to slow the spread of COVID-19, which in turn would enable economies to reopen and consumers and businesses to resume more normal activities. More than $3 trillion in government assistance in the form of one-time checks, supplemental unemployment insurance payouts, low interest loans to assist businesses, eviction moratoriums, and many more programs were intended to sustain the economy by limiting the damage while helping consumers, states, and businesses. However, much of the assistance has expired and cases of the coronavirus continue to increase, although the rate of increase has slowed.

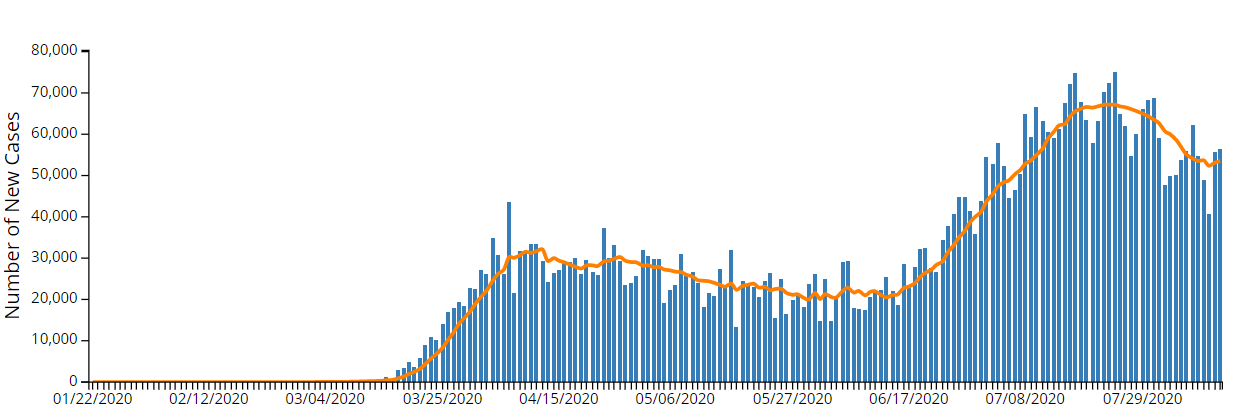

Number of New COVID-19 Cases Reported Daily

Source: Center For Disease Control And Prevention 8-13-2020

Source: Center For Disease Control And Prevention 8-13-2020

The University of Michigan Consumer Sentiment Index “sank further in late July due to the continued resurgence of the coronavirus.” Consumer income has increased, but not without the help of the government programs that have expired. More people are employed, but permanent job losses remain at historical highs. What should be done?

- Continue Testing and Working Diligently to Develop a Vaccine. The bottom line is the economy will not return to pre-pandemic levels until the public feels safe. Everybody must do their part. The coronavirus is not going away soon, and the spread of COVID-19 will determine the economy’s direction into the third and fourth quarters. Our choice is whether we acknowledge the danger and work together to contain the spread by responsibly practicing social distancing - or we remain careless and deny the ruthlessness of the virus. By working together, the economy will fare better and continue its improvement, but denial will force our leaders to curb economic activity, which will slow the economy, and delay the recovery.

- Extend Unemployment Benefits. The economy would have deteriorated much more without the $2 trillion investment by the federal government in the Coronavirus Aid Relief and Economic Security Act (CARES). Consumer spending and employment increased after households received one-time stimulus checks, a weekly $600 unemployment insurance supplement, and other measures. Sadly, continued investment is needed. Unemployment benefits are generally spent soon after they are received, which would not only benefit the struggling households, but also help businesses, and the economy. People who are sick must remain home – even if they are asymptomatic. The added supplemental unemployment payment provides such an incentive. Critics believe that $600 weekly income supplement is too generous and provides a disincentive to seek employment since most workers receive more than if they worked. (Read the Congressional Budget Office's report, Economic Effects of Additional Unemployment Benefits of $600 per Week.) The criticism is warranted and suggests the supplement should be reduced and phased out when job opportunities become more readily available.

- Invest to Safely Open Schools and Day Cares. Preparing our schools and day cares to open requires enormous investments that many school districts and day cares cannot afford. Helping our schools will pay enormous dividends. First, fewer children will get sick. Second, more workers will be able to work more productively. It certainly would be very difficult to monitor a young child at home while working remotely!

- Continue to Assist Businesses. The Paycheck Protection Program was included in the CARES Act to help businesses retain employees and provide capital during the pandemic by providing low interest loans that may be forgiven if employees are retained for eight weeks. A study by MIT’s Department of Economics, concluded that between 1.4 and 3.2 million jobs were saved through the first week of June. But many businesses have exhausted their funds. While many businesses are reopening, permanent business closures are increasing. Yelp reported 15,742 businesses closed permanently between June 15th and July 1st. This understates the number because it only includes those businesses that are listed on Yelp’s web site. Yelp also concluded that “Overall, permanent closures have steadily increased since the peak of the pandemic with minor spikes in March, followed by May and June.” (Q2 Yelp Economic Average) Closed businesses result in long-term unemployment, which prolongs the recession.

- Continue to Assist States. State and municipal governments are at the forefront of fighting the virus. Much of the financial burden has been placed on states, including funding their share of unemployment insurance, the cost of opening schools, and testing. Unfortunately, state governments are in a very precarious position. Revenues from income and sales taxes have plummeted. Most states are required to maintain a balanced budget, which has forced them to cut programs and jobs. State expenditures fell 5.6% in the second quarter. They need federal help to limit the economic harm of either sacrificing public health or cutting workers.

- Be honest and level with the public. There are many unknowns. Uncertainty is one of the main reasons the consumer sentiment index fell. Frightened consumers save more and spend less, so if an unemployed worker feels she cannot rely on extra benefits, she will spend less. State governments need to know if federal help will be available as they struggle with balancing budgets. Uncertainty will lead to budget cuts and less help for residents and businesses. Business owners hate uncertainty. Many questions remain surrounding the Payment Protection Program. Several are addressed in this CNBC article. Will businesses need to apply for a new federal loan? When would they have to repay a deferment of payroll taxes? Is a business still liable if an employee leaves and owes deferred payroll taxes? Open one day, closed the next, adds cost and stress where it is unnecessary.

President Trump’s executive order to defer payroll taxes could help by increasing workers disposable income. Presently, workers pay 6.2% of their income in social security on income less than $137,500. President Trump’s orders would only apply to workers earning less than $100,000, and only last between September 1st and the end of the year. This money would be received immediately. A deferment just postpones when the tax is due. Will the tax eventually be forgiven? Many employers may continue to collect payroll taxes if they are uncertain of their future liability.

A payroll tax only helps the employed – not those who lost their jobs. To help the unemployed, President Trump’s order continues to supplement unemployment insurance, but reduces the amount to $400, of which $100 is to be paid by the state. It is doubtful that most states, who are struggling with their own budgets, will contribute $100, so the net result is most of the jobless would receive a weekly supplement of $300, half of what they received in July.

Last month we asked our readers to share any positive developments in their lives. A golfing friend shared that he is playing more golf since the pandemic. He is not alone. He met several others who he now plays with every week. If you have a positive story you would like to share, please email it to info@higherrockeduction.com.

Stay Healthy,

Source: Center For Disease Control And Prevention 8-13-2020