The inflation figures from the Bureau of Labor Statistics (BLS) press release: Consumer Price Index (CPI) – June 2025

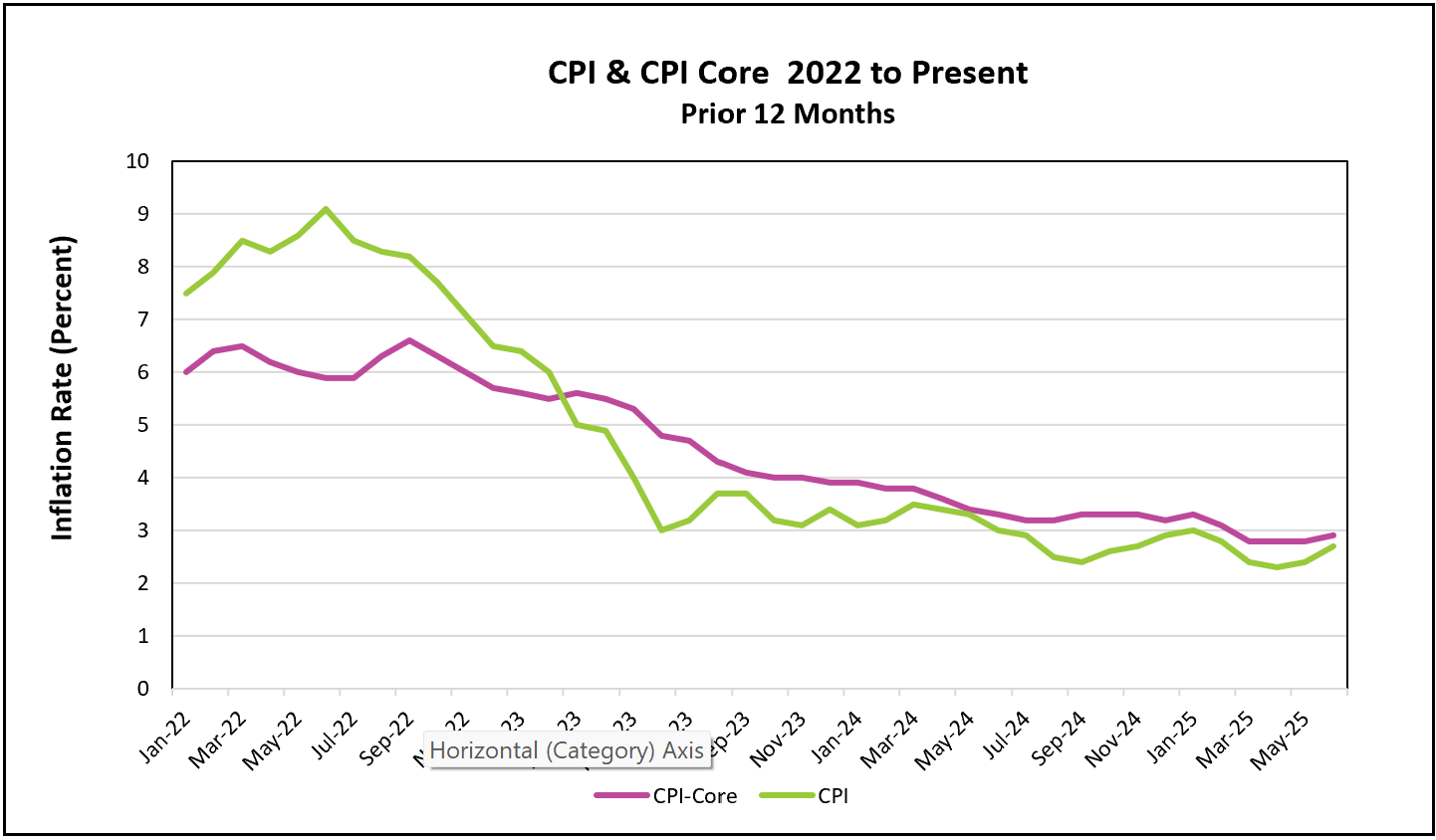

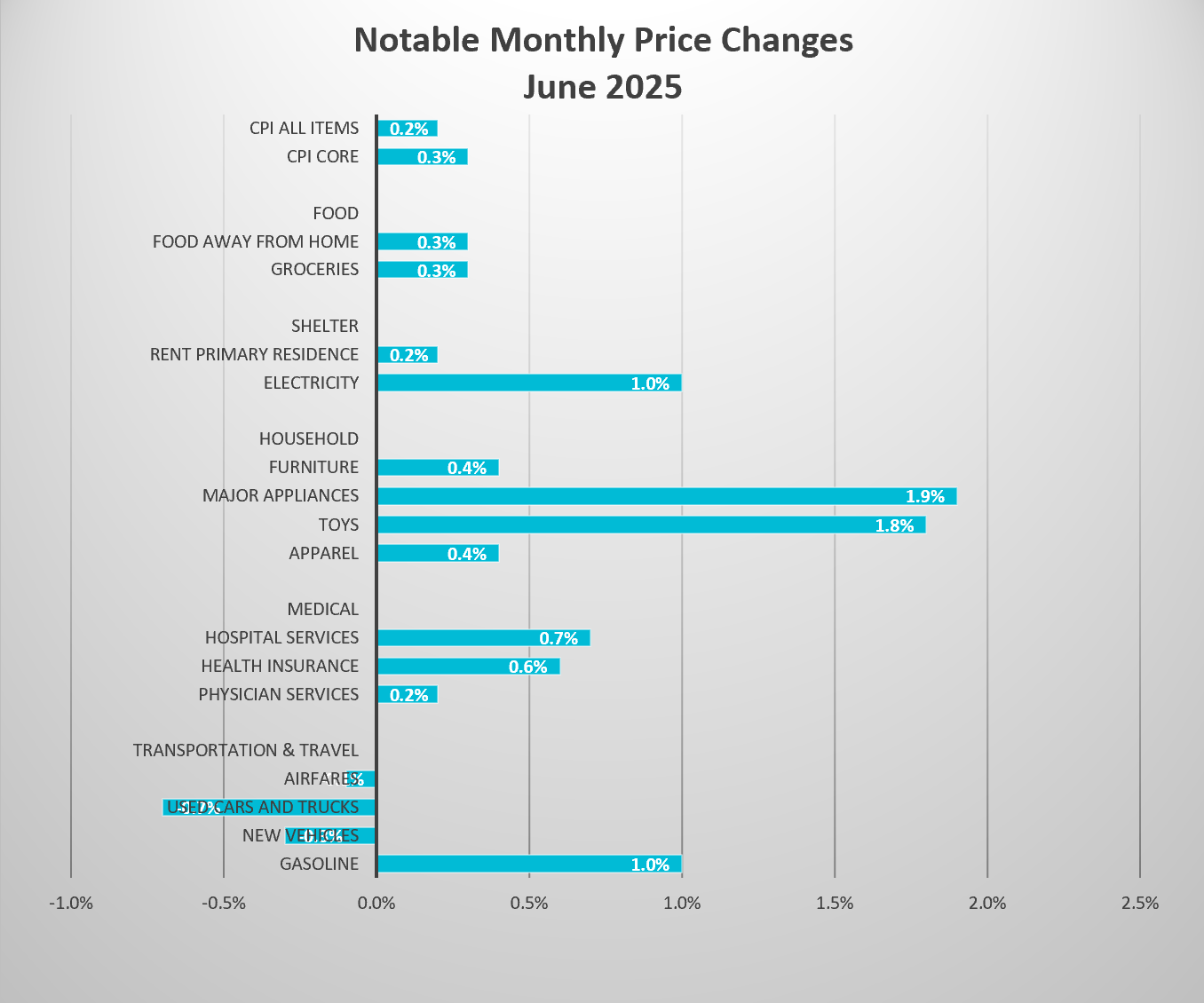

All measures of inflation accelerated in June, offering clear signs that the recent wave of tariffs is beginning to ripple through the economy. The all-items Consumer Price Index (CPI-U) rose by 0.3% in June, up from just 0.1% in May. Core CPI, which excludes food and energy, increased 0.2%, doubling the previous month’s gain. On a year-over-year basis, the all-inclusive inflation rate climbed to 2.7% from 2.4%, marking its highest level in five months. Meanwhile, core inflation ticked up slightly to 2.9% from 2.8%. These increases suggest that inflationary pressures are broadening, with tariffs playing a growing role.

Historically, government policies like tariffs take several months before showing up in economic data. For example, it took months after the 2018 tariffs on washing machines before their effects were fully captured in prices. Similarly, while the latest round of tariffs began months ago, implementation delays and business strategies to mitigate immediate impacts have postponed their effects. One such delay stems from the stockpiling of goods by consumers and companies ahead of tariff implementation. However, signs are emerging: the index for household furnishings, a tariff-sensitive category, jumped 1% in June—up from 0.3% the previous month—indicating that the pass-through of higher import costs is beginning.

The prices of goods are more immediately susceptible to tariffs because goods—such as electronics, furniture, and food—are often directly imported and subject to border taxes. Tariffs increase the cost of these imported items, and businesses usually pass those increases on to consumers. Domestic manufacturers may be susceptible to tariffs because they often rely on imported raw materials or finished products. In contrast, services rely more heavily on domestic labor and infrastructure, so their prices don’t respond as quickly. However, as the cost of goods and business inputs rise, service providers—such as repair shops, restaurants, and transportation companies—eventually face higher operating costs, which can lead to broader price increases over time.

Companies affected by tariffs are caught between two difficult choices: absorb the higher costs and cut into profits, or raise prices and risk losing customers. So far, the data suggest many firms have taken a cautious middle path. However, this may change quickly, especially as President Trump has threatened additional tariffs set to take effect on August 1st. These include a sweeping 30% levy on goods from the EU, Canada, Mexico, and several other countries. If implemented, it will likely be several more months before the full effect is reflected in consumer prices.

June’s inflation was also driven by a rebound in gasoline prices, which surged for the month, although they remain 8.3% lower than a year ago. Food prices climbed 0.3%, and new threats of 50% tariffs on Brazil could further increase food costs. Brazil is a key supplier of oranges and coffee beans. But not all prices are rising: the cost of new and used vehicles and travel-related expenses declined, likely due to weakening demand. The shelter index rose a modest 0.2%, continuing a slower upward trend.

While some economists believe the worst of inflation is still ahead, as tariffs extend deeper into the service sector, others are less convinced. They argue that as overall economic growth slows and consumer demand softens, the inflationary push from tariffs could be counteracted. They fear stagflation, when there is little or no economic growth and inflation. President Trump, concerned that the economy may lose momentum heading into an election cycle, has continued to pressure the Fed to lower rates. But with inflation stirring and economic signals mixed, policymakers find themselves navigating a narrowing path between overheating and stagnation. Stagflation poses a dilemma for the Federal Reserve: fighting inflation typically requires raising interest rates, but stimulating a slowing economy demands the opposite. This economic paradox has prompted the Fed to adopt a cautious “wait and see” posture.

The central bank is also closely watching the labor market, which remains strong but has shown early signs of softening. Inflation-adjusted wages, while still positive year-over-year, declined in June, indicating that consumers may soon be unable or unwilling to absorb higher prices. Meanwhile, other Trump administration policies—ranging from reduced immigration and tax cuts to spending rollbacks and deregulation—add further complexity to the economic outlook.

The resilience of consumer spending and household income has prevented the economy from entering a recession. The Bureau of Economic Analysis (BEA) will release Personal Income and Outlays – June 2025 on July 31st, offering June’s consumer spending and household income data. The report also includes June’s PCE price index, the inflation measure favored by the Federal Reserve. HRE will publish a summary and analysis shortly after the report is released.